What are Stablecoin Reserves?

Issuers of stablecoins normally maintain a reserve stock of the currency – but what does that actually mean?

Reserve stocks can often be thought of as the collateral underpinning the stablecoins themselves.

An example would be that £10,000 of GBPT tokens have an equal £10,000 of Great British Pounds locked away in a secure place that they can be redeemed for. In this case, the reserves can be used to fulfil conversions to the original asset at any given time, as there are enough reserves to conduct this swap.

In some cases, stablecoins do not back their reserves completely, leading to events such as the collapse of the algorithmic stablecoin called UST ($UST). Contrastingly, the crypto-backed stablecoin called DAI ($DAI) overcollateralizes its reserves. DAI is proof over-collateralization works as they have stood steadfast during multiple market crashes where volatility would otherwise cause an issue for crypto-backed stables.

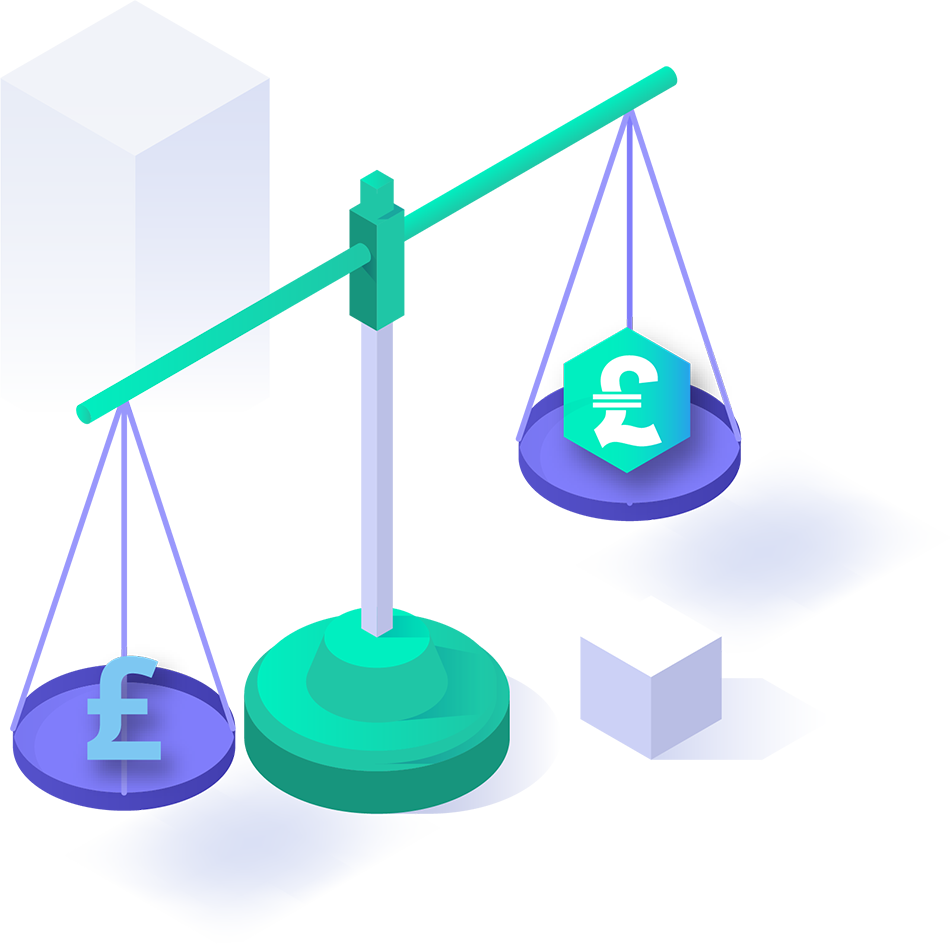

A stablecoin’s reserves also work in conjunction with the peg of the stablecoin:

- If the reserves have the same or a greater value than the stablecoins which have been issued > the peg is maintained (this is a 1:1 peg)

- If the reserves have a lesser value than the issued stablecoins > the peg is not maintained (until reinstated via increased reserves)

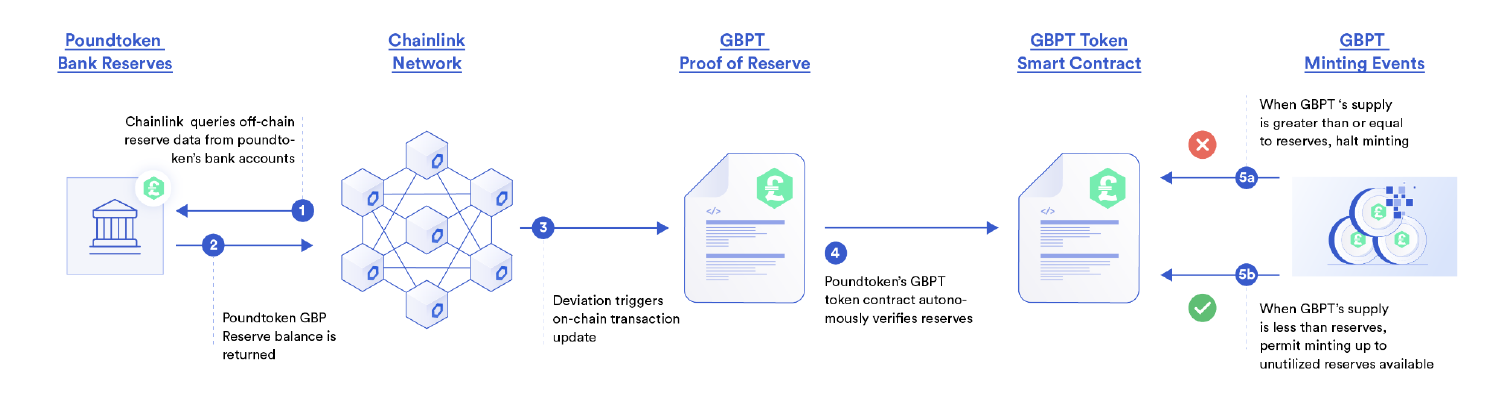

Recently, the concept of ‘Proof of reserves’ has become very popular due to a lack of insight into what reserves truly back a stablecoin. Centralised exchanges such as Kraken, Binance and others have done this for their wallets, and as of more recent times, stablecoin issuers are doing this for their products.

Chainlink’s ‘PoR’, proof of reserve, enables access to “decentralized, aggregated, cryptographically secured, on-chain quantities” for the reserve asset and the stablecoin it supports. This allows for increased transparency for both on-chain and off-chain assets, which provides facts and figures on the level of collateral the stablecoin has.

This form of communication instils faith in consumers and users and also upholds the issuer to keep the reserves topped up as they are doing so ‘in public’.

Being able to validate and verify underlying assets, which are the reserve assets of a stablecoin, is something which is very important in this space. Having the proof and the ability to prove the reserves of an asset being backed is a great tool to increase the security and faith in what the stablecoin has.

You can find out more about Poundtoken’s own reserves for the GBPT stablecoin here. For more information, visit our complete guide to stablecoins.